A 1.25% rise in National Insurance will be reversed from 6th Nov.

In April, it was announced by ex-Chancellor Rishi Sunak that we would see a rise of 1.25% to National Insurance and a levy to fund health and social care was going to be put in place in April 2023. However our new Chancellor Kwasi Kwarteng has axed the levy and reversed the proposed 1.25% rise in National Insurance.

The levy was expected to raise around £13bn a year to fund social care and deal with an NHS backlog that built up during Covid. The funding to health and social care will now come from general taxation.

According the Treasury, almost 28 million workers will keep an extra £330 of their money on average in 2023-24 with an additional saving of around £135 on average this year.

This will also benefit around 920,000 firms, who will see a tax reduction of around £9,600 now they don’t need to pay a higher level of employer National Insurance. Small and medium companies who see their NICs bills reduced, the average saving of £4,200 for small businesses and £21,700 for medium sized firms in 2023-24.

How much will you pay?

The threshold to pay National Insurance is £12,570 per year, so if you earn under £12,570 you won’t pay any National Insurance, and if you earn over £12,570 per year you will.

- You will pay no National Insurance on the first £242 you earn per week

- You will pay 13.25% on earnings between £242.01 and £967.00

- You will then pay 3.25% on the rest of the money you earn

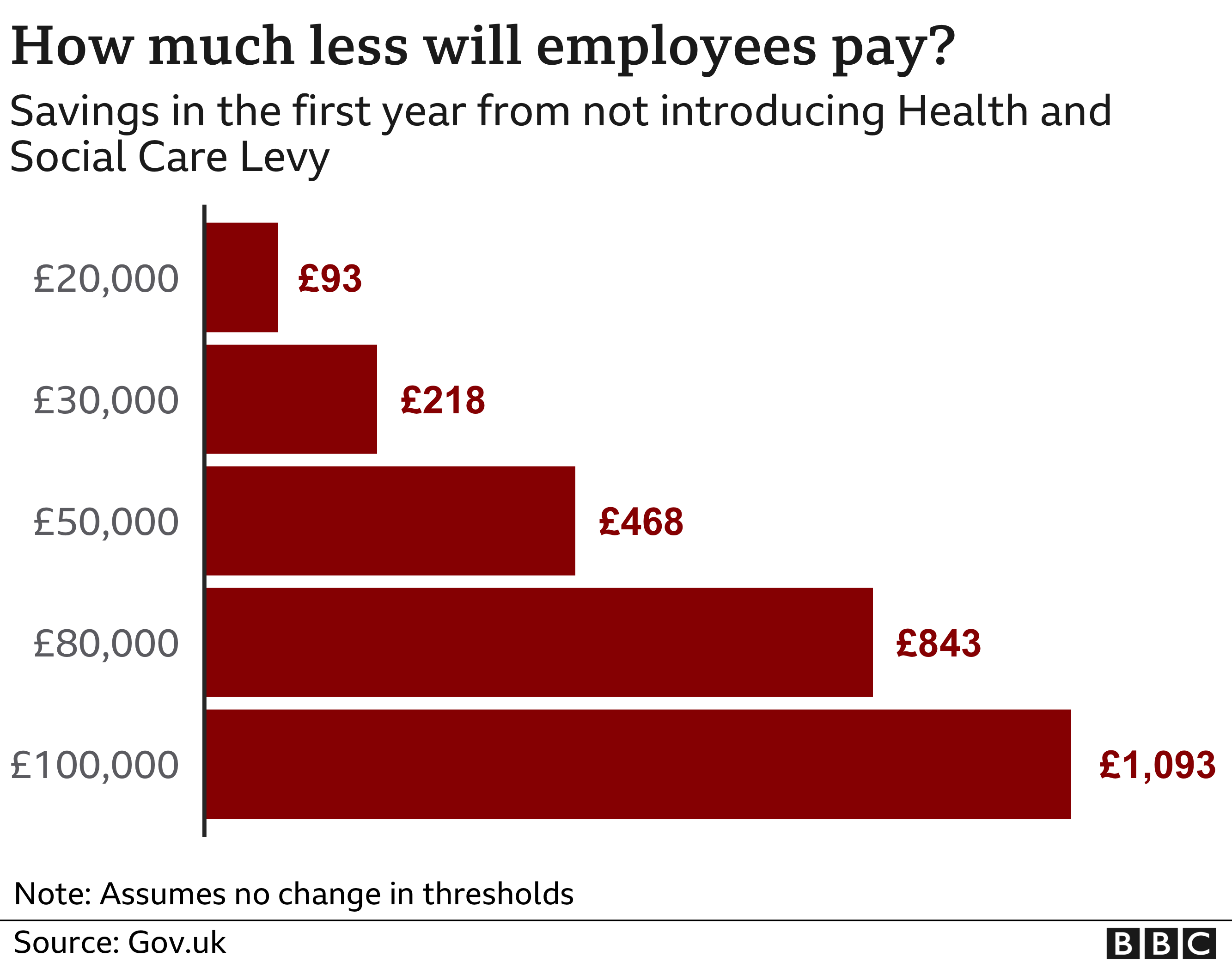

How much will you save?

The average saving will be £135 this financial year. Please see the graph below for some annual salary examples:

What does your National Insurance contribute to?

- The NHS

- Unemployment benefit

- Sickness and disability allowances

- The state pension

Where can I find my National Insurance number?

- On your payslip

- On your P60

- On letters about your tax, pension or benefits

- In the National Insurance section of your personal tax account

Click to read more on our blog…

Search our vacancies at your local Essential branch:

Barnsley https://bit.ly/3faUMhn

Burton https://bit.ly/3fcYRSa

Chesterfield https://bit.ly/3vQNF4u

Doncaster https://bit.ly/3NInFl5

Mansfield https://bit.ly/3xZ43BU

Ripley + Long Eaton https://bit.ly/3tBF6t0

Rotherham https://bit.ly/33vYAEL

Worksop https://bit.ly/3uyEzZY

Would you like to register with us? Add your details into this form and we’ll give you a call